The US and China have been exchanging threats and imposing tariffs in a ‘trade war’ since early 2018. Sound statistical and holistic economic analysis of the trade dispute’s consequences is difficult due to data limitations.

This column scrutinises global stock market responses to assess the effects of the trade war and finds that, on average, the US and Chinese tariffs have directly hurt targeted firms/sectors abroad as intended, but they have also hurt firms at home. It also reveals unintended effects on third parties, mediated by global value chain interdependencies.

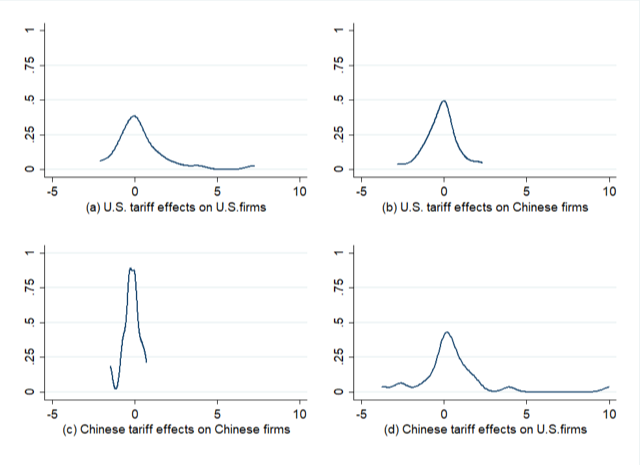

Figure 1 Estimated direct trade war tariff effects on firms’ stock market prices (%)

Notes: The panels show the overall direct effects of tariff changes, in percent, defined as the coefficient estimates per sector multiplied by the tariff changes by sector. These represent density estimates. A higher elevation suggests that a larger share of sector effects occurs in the neighbourhood of percentage effects recorded on the horizontal axis.

Continue reading and see these above figure at a size you can read!

Labels:

USA, China, US-China_trade_war, trade_war, tariffs, global_value_chains,

No comments:

Post a Comment